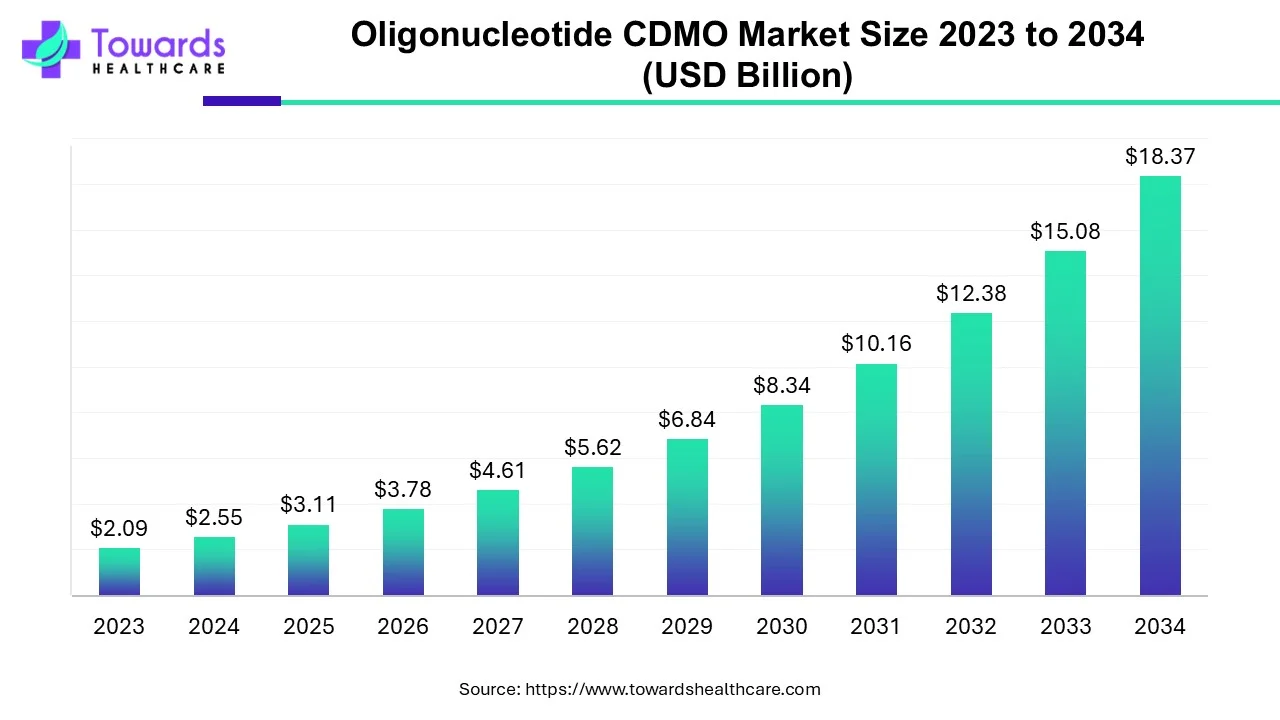

Oligonucleotide CDMO Market to Soar USD 18.37 Billion at 21.83% Strong CAGR by 2034

The global oligonucleotide CDMO market is valued at USD 3.11 billion in 2025 and is projected to reach approximately USD 18.37 billion by 2034, expanding at a CAGR of 21.83% over the forecast period.

Ottawa, Aug. 08, 2025 (GLOBE NEWSWIRE) -- According to a study by Towards Healthcare, a sister company of Precedence Research, the global oligonucleotide CDMO market size to grow from USD 2.55 billion in 2024 and is expected to expand USD 18.37 billion by 2034.

The growth of the market is driven by the increased demand for specialized techniques, which are technologically advanced due to the growing prevalence of chronic diseases in the region.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5461

Key Takeaways

- North America dominated the oligonucleotide CDMO market in 2024.

- Asia Pacific is estimated to grow at the fastest CAGR during the forecast period.

- By service, the contract manufacturing segment led the market in 2024.

- By service, the contract development segment is estimated to achieve significant growth during the forecast period.

- By type, the ASO segment held a significant share of the market in 2024.

- By type, the siRNA segment is expected to grow significantly during the forecast period.

- By application, the therapeutic segment held the largest share of the oligonucleotide CDMO market in 2024.

- By application, the research segment is anticipated to grow at a significant rate during the forecast period.

- By end-use, the pharma segment held a major share of the market in 2024.

- By end-use, the biotech segment is anticipated to achieve a significant share of the market during the forecast period.

Market Overview & Potential

An oligonucleotide CDMO (Contract Development and Manufacturing Organization) specializes in offering comprehensive services for developing and manufacturing short oligonucleotides, which are synthetic nucleic acid sequences used in various biotech and pharmaceutical applications. These organizations provide expertise in custom synthesis, process development, scale-up, and GMP manufacturing of oligonucleotides.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What Is the Growth Potential Responsible for The Growth of The Oligonucleotide CDMO Market?

The growth of the market is driven by the growing demand for personalized medicines and RNA therapeutics, which demand specialized manufacturing capabilities, which fuels the growth of the market. The increasing prevalence of chronic diseases, especially cancer and cardiovascular diseases, with advancements in oligonucleotide manufacturing to improve synthesis technologies with automated techniques, drives the growth of the market. Other key growth drivers are government support and funding, increased investment in biotechnology, globalization, and increased collaboration boost the growth of the market.

What Are the Emerging Trends in the Oligonucleotide CDMO Market?

Growing Demand for Oligo-based Therapies:

- Oligonucleotides, including antisense oligonucleotides and small interfering RNAs, are increasingly recognized as therapeutic agents because of their targeted action and specificity.

Focus on Precision Medicine:

- The shift toward personalized treatments designed for individual patients is boosting the need for specialized oligonucleotide therapies.

Increased FDA Approvals:

- The rising number of FDA approvals for oligonucleotide-based drugs, such as Qalsody for ALS, further fuels market growth and stimulates innovation.

Cost Efficiency and Expertise:

- Outsourcing to CDMOs enables companies to utilize specialized knowledge and potentially lower costs associated with in-house manufacturing, particularly for complex processes.

What Are the Major Challenges Facing the Oligonucleotide CDMO Market?

The market encounters several notable challenges, mainly due to manufacturing complexity, regulatory obstacles, and the need for advanced expertise and infrastructure. Scaling from research to commercial volumes, achieving high purity, and ensuring delivery efficiency to target sites are significant hurdles. Evolving regulatory requirements and the need for specialized skills in oligonucleotide synthesis, purification, and conjugation also contribute to the difficulty.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Regional Insights

Why Did North America Lead the Oligonucleotide CDMO Market in 2024?

North America held a dominant position in 2024 due to its well-established research facilities, substantial R&D investments in peptide and oligonucleotide therapies, and a higher prevalence of chronic diseases. The demand for biopharmaceuticals like oligonucleotides and peptides supports this growth. North American CDMOs are well-equipped to meet this demand by providing specialized development and manufacturing services for these complex compounds. The market expansion is driven by ongoing investments from pharmaceutical and biotech firms into R&D, often through partnerships with CDMOs to access advanced infrastructure and expertise.

High R&D investment, advanced biotech infrastructure, rising chronic disease prevalence, and strong pharmaceutical industry demand drive U.S. oligonucleotide CDMO growth. Regulatory clarity from the FDA, increasing personalized medicine focus, and government support for genomics research further enhance market expansion, fostering innovation and strategic collaborations with contract manufacturers.

Government incentives for biotechnology, a skilled scientific workforce, and growing demand for precision medicine propel Canada's oligonucleotide CDMO sector. Strong academic-industry partnerships, supportive regulatory frameworks, and increasing investments from global pharma companies in Canadian CDMO facilities promote innovation, clinical trials, and manufacturing scalability within the country.

Why Is Asia Pacific Projected to Show Rapid Growth in the Oligonucleotide CDMO Market?

Asia Pacific is anticipated to be the fastest-growing region for oligonucleotide CDMOs during the forecast period. Countries like China, Japan, India, and South Korea are leading due to their large populations, focus on biopharmaceutical innovation, and strong healthcare investments. The region's market share has notably increased over recent years, supported by economic growth and rising prosperity, making it attractive for pharmaceutical outsourcing. This growth is further fueled by increased R&D funding and improvements in healthcare infrastructure.

Rapid biotechnology expansion, government funding, and a large patient population fuel oligonucleotide CDMO growth in China. Domestic pharma companies increasingly outsource production, while favorable policies, infrastructure development, and cost advantages attract global partnerships. China’s focus on RNA therapeutics and local innovation also accelerates CDMO sector maturation and competitiveness.

Low manufacturing costs, a strong generic pharmaceutical base, and a growing talent pool drive India's oligonucleotide CDMO growth. Government initiatives supporting biotech innovation, rising contract research demand, and increased interest from Western firms in Indian CDMOs contribute. The expanding clinical trial ecosystem further enhances market attractiveness and outsourcing potential.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Segmental Insights

Which Service Segment Dominated the Oligonucleotide CDMO Market in 2024?

The contract manufacturing segment led the market in 2024, driven by the rising need for wide-scale, cGMP-compliant oligonucleotide APIs for clinical and commercial use. To meet the growing demand for ASOs, siRNAs, and mRNA-based therapies, CDMOs equipped with advanced solid-phase synthesis, automated fill-finish systems, and high-throughput purification are vital. This leadership is reinforced by pharmaceutical companies' reliance on CDMOs for high-purity, scalable, and globally compatible manufacturing solutions, driven by strict regulations and expansion challenges. This led to a growing and expanding influence on market growth.

The contract development segment is estimated to achieve significant growth during the forecast period. Encompassing services like preclinical development, formulation, process development, and analytical techniques. These services are crucial for optimizing production processes and ensuring the safety and quality of oligonucleotides and peptides. R&D in oligonucleotide therapies is a key investment focus for pharma and biotech companies. Partnering with CDMOs allows these companies to reduce costs and accelerate product development, focusing on their core competencies.

How did ASO Segment Dominated the Oligonucleotide CDMO Market in 2024?

The ASO segment held a significant share of the market in 2024. Over the decades, the biotech and pharma industries have developed innovative approaches to target disease-related proteins, demanding innovation and development of new technologies and forms of products, which increases the demand for the market. RNA therapeutics, especially antisense oligonucleotides, have made significant progress in the market. Several ASO-based drugs are already FDA-approved, with many more under clinical testing. These factors support the growth and expansion of the market.

The siRNA segment is expected to grow significantly during the forecast period. SiRNA technologies offer speed and specificity, helping to overcome preclinical drug development hurdles, which fuels the demand for the market. They currently assist in identifying the most promising pharmacological targets for specific diseases and are being explored for new, potent applications in drug candidate prioritization. These applications and benefits offered by the segment promote the growth and expansion of the market.

Which Application Segment Dominated the Oligonucleotide CDMO Market in 2024?

The therapeutic segment held the largest share of the market in 2024. Approaches have been developed to enhance the pharmacokinetics and pharmacodynamics of oligonucleotides. Historically targeted at rare diseases and niche markets, oligonucleotides now benefit large patient groups. The field is rapidly expanding despite fluctuations, with 44 companies having compounds in late-stage clinical trials or on the market. Major players include Johnson & Johnson, Roche, Novartis, and AstraZeneca, alongside specialized biotech firms like Ionis Pharmaceuticals and Alnylam Pharmaceuticals. Concurrently, there has been notable activity in oligonucleotide patents and applications influencing the growth.

The research segment is anticipated to grow at a significant rate in the oligonucleotide CDMO market during the forecast period, with contributions from research institutions impacting early-stage research, innovative technologies, and scientific breakthroughs. These institutions are vital in identifying therapeutic potentials, fostering partnerships with CDMOs and pharma companies, and influencing market dynamics. Advances in distribution, analytics, and synthesis are driving market expansion, and published research influences development and manufacturing strategies.

How did the pharma Segment dominate the Oligonucleotide CDMO Market In 2024?

The pharma segment accounted for a major market share in 2024. The advent of oligonucleotide therapies has revolutionized medicine, with several approved in the US and EU. These include a mix of single and double-stranded polydeoxyribonucleotides, six siRNAs, twelve ASOs, and one aptamer. The growing pharma sector and the application of oligonucleotides increase the demand for manufacturing and production, which contributes to the growth and expansion of the market.

The biotech segment is also expected to claim a significant market share, enabled by protein-DNA functionalization through covalent bonding. This technology facilitates the creation of therapeutic molecules with potential applications for diseases like AIDS and cancer. The ongoing research and development in the biotech sector further propels the growth and expansion of the market.

Recent Developments in the Oligonucleotide CDMO Market

- In April 2025, Sumitomo Chemical announced the launch of its new company, Sumitomo Chemical Advanced Medical Solutions America LLC, in Massachusetts to serve as its Oligonucleotide CDMO2 business. The company will provide gRNA samples to customers by August 2025.

- In July 2024, Agilent Technologies announced a strategic agreement to acquire BioVectra, a specialized CDMO, for $925 million. The acquisition was made to build Agilent Technologies’ CDMO specialization in oligonucleotides and CRISPR therapeutics, expanding its portfolio of services and bringing world-class capabilities to support gene editing.

Browse More Insights of Towards Healthcare:

The global life science CDMO market is witnessing rapid expansion, with revenues projected to reach several hundred million dollars by the end of the forecast period (2025–2034).

The veterinary CRO and CDMO market was valued at USD 7.17 billion in 2024, is expected to reach USD 7.77 billion in 2025, and is projected to climb to approximately USD 16.13 billion by 2034, growing at a CAGR of 8.43% during 2025–2034.

The advanced therapy medicinal products (ATMP) CDMO market stood at USD 6.73 billion in 2024, increased to USD 7.99 billion in 2025, and is forecast to surge to USD 37.27 billion by 2034, registering a CAGR of 18.82% from 2025 to 2034.

The investigational new drug CDMO market was valued at USD 5.29 billion in 2024, rose to USD 5.66 billion in 2025, and is anticipated to reach USD 10.34 billion by 2034, expanding at a CAGR of 6.97% between 2025 and 2034.

The mRNA therapeutics CDMO market was worth USD 4.62 billion in 2024, increased to USD 5.15 billion in 2025, and is projected to grow to USD 13.63 billion by 2034, recording a CAGR of 11.37% during 2025–2034.

The CDMO services for pharma and biotech market is experiencing substantial growth from 2024 to 2034, fueled by the increasing outsourcing trend among pharmaceutical and biotechnology companies.

The CDMO aseptic filling solutions market is set for strong growth throughout the forecast period, driven by rising demand for sterile manufacturing capabilities and specialized injectable therapies.

The active pharmaceutical ingredients (API) CDMO market was valued at USD 127.45 billion in 2024, increased to USD 136.92 billion in 2025, and is estimated to reach USD 260.98 billion by 2034, growing at a CAGR of 7.43% from 2025 to 2034.

The small molecule CDMO market stood at USD 72.81 billion in 2024, rose to USD 78.01 billion in 2025, and is forecast to hit USD 145.12 billion by 2034, expanding at a CAGR of 7.14% during 2025–2034.

The topical drugs CDMO market was worth USD 46.32 billion in 2024, increased to USD 51.62 billion in 2025, and is expected to reach USD 136.71 billion by 2034, registering a CAGR of 11.43% between 2025 and 2034.

Top Companies and Their Contributions to the Market

| Contributions & Offerings to the Oligonucleotide CDMO Market | |

| Bachem | A global leader in peptide and oligonucleotide synthesis, Bachem offers full CDMO services including development, GMP manufacturing, and analytics. |

| Thermo Fisher Scientific Inc. | Provides end-to-end oligonucleotide services, from preclinical to commercial scale, leveraging advanced technologies and global infrastructure. |

| Agilent Technologies, Inc. | Offers custom oligo synthesis and quality control platforms, supporting therapeutic development with scalable manufacturing capabilities. |

| EUROAPI | Delivers active pharmaceutical ingredient (API) production, including oligonucleotides, with a focus on quality, sustainability, and innovation. |

| ST Pharm | Specializes in large-scale GMP oligonucleotide manufacturing, supplying APIs globally with expertise in modified nucleic acids and cGMP compliance. |

| Kaneka Eurogentec S.A. | Provides custom manufacturing of therapeutic oligonucleotides, with cGMP-grade synthesis, formulation, and analytical support. |

| Ajinomoto Co., Inc. | Leverages proprietary biotechnologies for oligonucleotide production, offering scale-up and process development through its CDMO division. |

| Aurigene Pharmaceutical | Offers integrated CDMO services including oligonucleotide synthesis, analytical development, and GMP manufacturing for global biopharma clients. |

| Syngene International | Provides end-to-end oligo development and manufacturing, supporting early-stage to commercial scale with regulatory expertise. |

| PolyPeptide Group | Recently expanded into oligonucleotide CDMO services, combining peptide and oligo synthesis capabilities with advanced regulatory compliance. |

Key Players in Oligonucleotide CDMO Market

- Bachem

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- EUROAPI

- ST Pharm

- Kaneka Eurogentec S.A.

- Ajinomoto Co., Inc.

- Aurigene Pharmaceutical Services Ltd.

- Syngene International Limited

- PolyPeptide Group

- WuXi AppTec

- Eurofins Scientific

- GenScript

- Lonza

- Danaher Corporation

Segments Covered in The Report

By Service

- Contract Manufacturing

- Clinical

- Commercial

- Contract Development

By Type

- ASO

- siRNA

- CPG Oligos

- gRNA

By Application

- Therapeutic

- Research

- Diagnostics

By End-User

- Pharma

- Biotech

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5461

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region - +44 778 256 0738

North America Region - +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.